Mileage Log for Reimbursement Document Template

Track business travel mileage for tax deductions or company reimbursement.

Mileage Log for Reimbursement

This document is designed to help employees or self-employed individuals maintain a detailed log of business-related vehicle mileage for the purposes of tax deductions or company reimbursement. It captures essential details of each trip including date, destination, purpose, starting and ending mileage, and total miles traveled. Complete and accurate records are critical for compliance with reimbursement policies and tax regulations.

Employee/Driver Information

- Name: {name}

- Department: {department}

- Vehicle Description: {vehicle}

- License Plate: {licensePlate}

- Reimbursement Period: {period}

Summary

- Total Business Miles: {totalMiles} miles

- Reimbursement Rate: ${rate} per mile

- Total Reimbursement Amount: ${totalAmount}

Mileage Log

| Date | Start Location | Destination | Purpose | Start Odometer | End Odometer | Miles Traveled |

|---|---|---|---|---|---|---|

| {#trips}{date} | {startLocation} | {destination} | {purpose} | {startOdometer} | {endOdometer} | {miles}{/trips} |

Notes

{notes}

Employee Signature: ____________________________

Date: {dateSigned}

Manager Approval: ____________________________

Date: {managerDate}

This document template includes dynamic placeholders for automated document generation with Documentero.com. Word Template - Free download

Download Word Template (.DOCX)Customize Template

Download the Mileage Log for Reimbursement template in .DOCX format. Customize it to suit your needs using your preferred editor (Word, Google Docs...).

Upload & Configure

Upload the template to Documentero - Document Generation Service, then map and configure template fields for your automated workflow.

Generate Documents

Populate templates with your data and generate Word (DOCX) or PDF documents using data collected from shareable web Forms, APIs, or Integrations.

Use Cases

Automate Mileage Log for Reimbursement Using Forms

Generate Mileage Log for Reimbursement Using APIs

Integrations / Automations

Other templates in Finance & Accounting

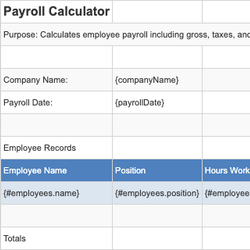

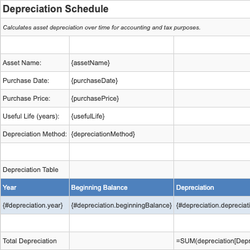

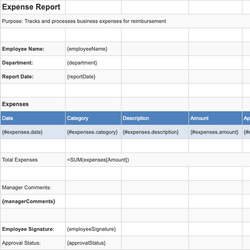

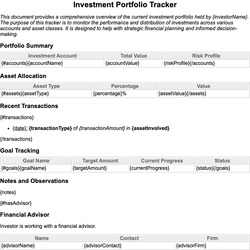

SpreadsheetXLSX

SpreadsheetXLSX

SpreadsheetXLSX

DocumentDOCX