Tax Return Calculator Spreadsheet Template

Helps estimate taxes owed by listing income, deductions, and tax rates for liability calculation.

| Tax Return Calculator | |

| This spreadsheet estimates your tax liability based on reported income, deductions, and defined tax rate. | |

| Name: | {name} |

| Tax Year: | {taxYear} |

| Income Sources | |

| Type | Amount |

| {#income.type} | {#income.amount} |

| Deductions | |

| Type | Amount |

| {#deductions.type} | {#deductions.amount} |

| Total Income | =SUM(income[Amount]) |

| Total Deductions | =SUM(deductions[Amount]) |

| Taxable Income | =SUM(income[Amount]) - SUM(deductions[Amount]) |

| Tax Rate (%) | 22% |

| Estimated Tax Owed | =IFERROR((SUM(income[Amount])-SUM(deductions[Amount]))*0.22, "") |

This document template includes dynamic placeholders for automated document generation with Documentero.com. Excel Template - Free download

Download Excel Template (.XLSX)Customize Template

Download the Tax Return Calculator template in .XLSX format. Customize it to suit your needs using your preferred editor (Excel, Google Sheets...).

Upload & Configure

Upload the template to Documentero - Document Generation Service, then map and configure template fields for your automated workflow.

Generate Documents

Populate templates with your data and generate Excel (XLSX) documents using data collected from shareable web Forms, APIs, or Integrations.

Use Cases

Automate Tax Return Calculator Using Forms

Generate Tax Return Calculator Using APIs

Integrations / Automations

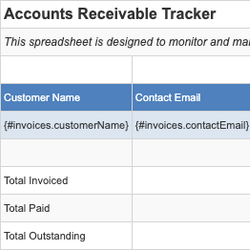

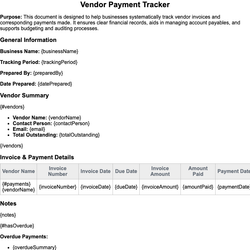

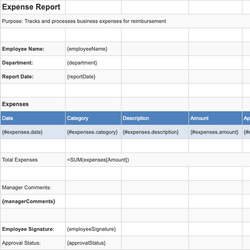

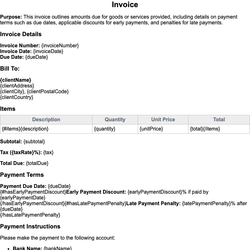

Other templates in Finance & Accounting

SpreadsheetXLSX

DocumentDOCX

SpreadsheetXLSX

DocumentDOCX