Tax Deduction Tracker Document Template

Track deductible business expenses for easier tax filing and documentation.

Tax Deduction Tracker

Purpose: This form helps individuals and businesses track deductible business expenses throughout the year in order to simplify tax documentation and ensure accurate filings.

Basic Information

Business Name: {businessName}

Tax Year: {taxYear}

Prepared By: {preparedBy}

Summary of Deductible Expenses

| Category | Description | Date | Amount (USD) |

|---|---|---|---|

| {#expenses}{category} | {description} | {date} | {amount}{/expenses} |

Monthly Totals

| Month | Total Expenses (USD) |

|---|---|

| {#monthlyTotals}{month} | {total}{/monthlyTotals} |

Expense Categories

This tracker includes the following common deductible categories:

{#categories}

- {name}: {description}

{/categories}

Additional Notes

{#hasNotes}

Notes: {notes}

{/hasNotes}

{^hasNotes}

No additional notes provided.

{/hasNotes}

Attachments

{#attachments}

- {fileName} - {fileDescription}

{/attachments}

This document template includes dynamic placeholders for automated document generation with Documentero.com. Word Template - Free download

Download Word Template (.DOCX)Customize Template

Download the Tax Deduction Tracker template in .DOCX format. Customize it to suit your needs using your preferred editor (Word, Google Docs...).

Upload & Configure

Upload the template to Documentero - Document Generation Service, then map and configure template fields for your automated workflow.

Generate Documents

Populate templates with your data and generate Word (DOCX) or PDF documents using data collected from shareable web Forms, APIs, or Integrations.

Use Cases

Automate Tax Deduction Tracker Using Forms

Generate Tax Deduction Tracker Using APIs

Integrations / Automations

Other templates in Finance & Accounting

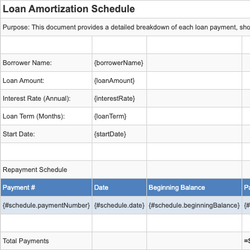

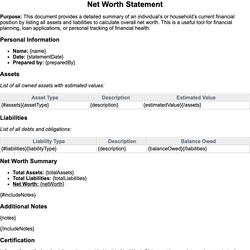

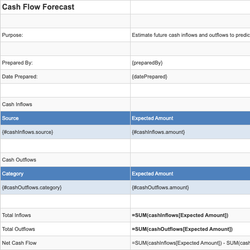

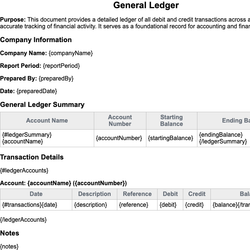

SpreadsheetXLSX

DocumentDOCX

SpreadsheetXLSX

DocumentDOCX